Problem → Solution: I got a $6,000 IRS fine, but knew what to say to remove it, and now you will too!

A quick one-page script to use when talking to the IRS about abating a penality.

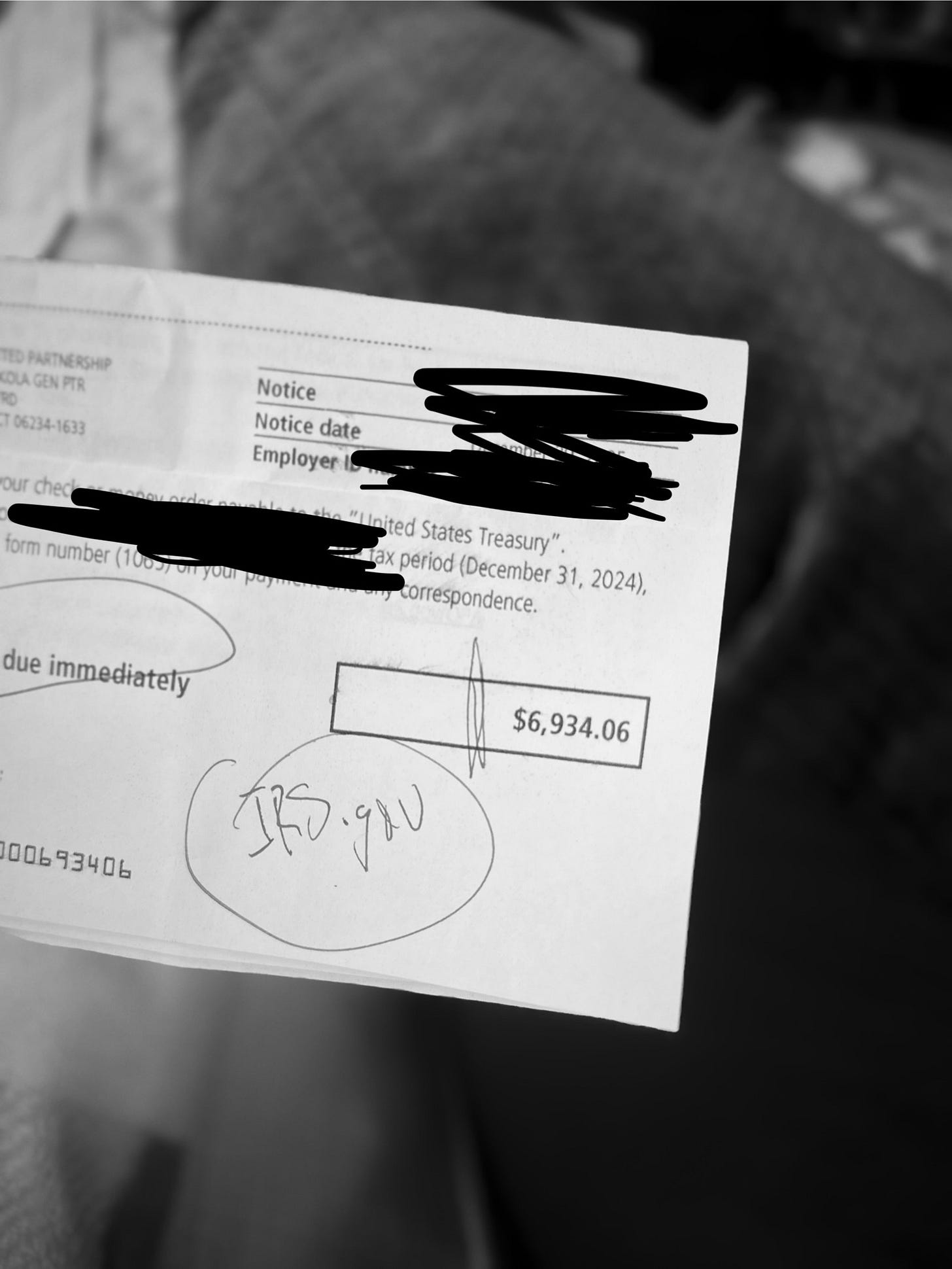

Problem: I got a $6,000 IRS fine because our film’s tax documents were late.

Solution: Call them and use the script below.

Dear Reader,

This was a scary one.

On my fortieth birthday, I got one completely unexpected card— from the IRS.

In it was a nearly $7,000 levied fine.

The Problem

You see, I had a medical crisis around tax filing season, thus resulting in my film’s investment partnership being a little late in filing our taxes.

My fault completely.

Don’t be like me.

I thought you could simply file an extension.

But you can’t with the specific business entity that my film is organized under.

This is because my business tax documents need to be issued early to my investors so that they can competently do their own taxes on time.

This means that Partnership taxes are due a month before, on March 15th.

So that personal income taxes can be filed on April 15th.

Hence, the IRS sent me a certified letter with a fine on my birthday!

It was a $250 fine per investor, per month that the filings were late.

Luckily, I knew there were two special exemptions that you can try to remove penalties when working with the IRS.

The Solution

Once you receive a penalty notice, the anxiety immediately sets in.

Don’t let it paralyze you.

Call the IRS and try one of these strategies.

Note: This is not legal advice, only for educational purposes.

Here is the exact strategy to get this waived during your phone call.

1. The Best Strategy: “Small Partnership Exception” (Rev. Proc. 84-35)

If you’re organized like a General or Limited Partnership like we are try this.

This is your “get out of jail free” card.

The IRS has a specific rule that waives late filing penalties for small partnerships if you meet the criteria.

You qualify if:

The partnership has 10 or fewer partners.

All partners are individuals (or estates of deceased partners).

Crucial: All partners have fully reported their share of the partnership income/loss on their own timely filed personal tax returns.

What to say on the phone:

“I am requesting abatement under Revenue Procedure 84-35. We are a small partnership with [Number] partners, and every partner has already reported their share of the income on their timely filed personal returns.”

2. The Backup Strategy: “First Time Abatement” (FTA)

If you don’t strictly qualify for the above (e.g., one partner filed their personal taxes late), you likely qualify for First Time Abatement.

You qualify if:

You have a “clean history” (no penalties) for the prior 3 tax years.

You have actually filed the return in question (even if late).

What to say on the phone:

“If Rev. Proc. 84-35 does not apply, I would like to request a First Time Abatement administrative waiver. We have a clean compliance history for the past three years.”

Possible Curveballs & Responses

Curveball 1: “We need you to send this request in writing.”

Response: “I understood that penalties like this could often be handled verbally over the phone to save time. Could you please check if you have the authority to resolve it now? If not, is there a fax number I can send my statement to while we are on the line?”

Curveball 2: “I can’t abate it because the amount is too high.”

Response: “Okay. In that case, can you please place a hold on collections (usually 9 weeks) so I have time to mail in the formal abatement letter without receiving further notices?”

Checklist Before You Call

Call the number on the notice (usually 800-829-0922 for businesses) early in the morning (start calling at 7:00 AM local time) to minimize hold times. Have this ready:

The Notice: Keep it in front of you (reference the “CP notice number” in the top right corner).

EIN: Your partnership’s Employer Identification Number.

Filing Date: The exact date you eventually filed the partnership return.

Partner Confirmation: Verify beforehand that your partners filed their personal taxes on time. The agent may ask, “Did all partners report this income on their 1040s?” You need to be able to say “Yes.”

Summary of Script

You: “Hi, I’m calling regarding a late filing penalty for my partnership. I’d like to request penalty abatement.” Agent: “On what grounds?” You: “I believe we qualify for relief under Revenue Procedure 84-35 as a small partnership. All partners reported their income on time. If that doesn’t apply for some reason, I would like to request First Time Abatement based on our clean compliance history.”

Final Thought

Pro Tip: Be polite but firm. Agents are often overworked, and being organized and pleasant can make them more willing to help you.

Pro Tip: Do your taxes on time.

I hope you never have to deal with the IRS but if you do, now you have a script.

We can do it.

Together, with faith.

— M.P. Rekola

P.S. How I Sustain the Work

I’m an independent creator. I don’t have a studio overhead or trust fund backing this work. I earn my living through:

Affiliate links, views, and one-time donations (click here).

Sales of The Modern Filmmaker’s On-Set Filmmaking Dictionary on Amazon

Producing industrial and commercial work through Goodworks (you can hire us)

Consulting on individual projects

And a micro drive-in movie theatre, I’m currently building

None of this is separate from the art.

It’s what allows the art to keep happening.

Reach out if you have an opportunity.

Reminder— advice & networking are always free.

![Rekola [Film Producer]'s avatar](https://substackcdn.com/image/fetch/$s_!TfHd!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4e2c9aad-8d02-433e-9823-601112a5f9f9_1179x1179.png)